You can use as many account sets as you need for your inventory items, but you must define at least one account set for your inventory items.

You can use as many account sets as you need for your inventory items, but you must define at least one account set for your inventory items.

Inventory account sets are groups of general ledger accounts to which you post Inventory Control transactions.You can use as many account sets as you need for your inventory items, but you must define at least one account set for your inventory items.

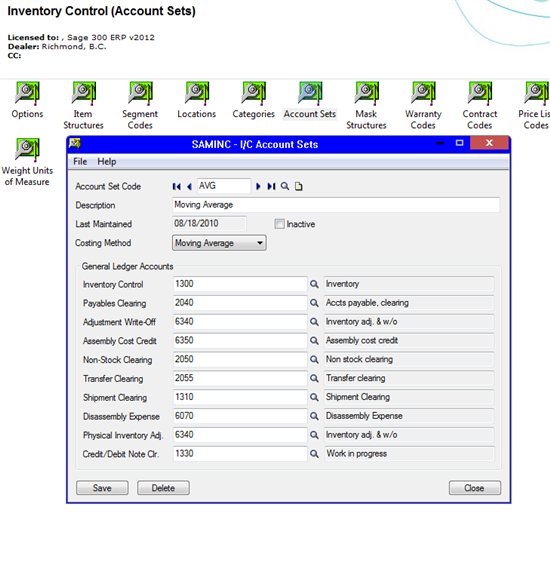

When you are in Inventory Control Account Sets, it displays a group of General Ledger account numbers that are used to categorize transactions by accounts to which they are posted in General Ledger. So let’s go through each of them that you see in the image below:

Inventory Control: When you receive an item into stock, the Inventory Control account is going to debit the item meaning it will increase the inventory. On the flip side, when you sell an item that account is credited and results in a reduction of inventory.

Payable Clearing: This is used for receiving goods. When you enter a receipt in inventory, it will only go into Accounts Payable once you have been invoiced by the supplier. When you go to invoice it, it will then debit the Payables Clearing account and credit the Accounts Payable account.

Adjustment Write-Off and Assembly Cost Credit: These are for specific transactions like IC Adjustments, and Bill of Materials. These are the default accounts that appear when you go adjust an item.

Non-Stock Clearing: If an item is not set up as an inventory item in a location, then there are no quantities so it is considered a non-stock item and will go to the non-stock clearing account.

Transfer Clearing: When you transfer an item from one location to another, there is a clearing account if you use the transit transfer.

For example, you have a warehouse in the West Coast with another on the East Coast and you want to send your goods from the West Coast warehouse to the one in the east. Obviously there is a physical distance that it has to travel to get there; as well, it could take up to six days to arrive to its new location. There is a process called a Goods in Transit location, which is not a physical location but is called a logical location. What happens is goods get transferred out of the West Coast location, gets put into the Goods in Transit location and from there those items are not available for the East Coast location. Also you cannot sell items from the Goods in Transit location until those goods actually reach the East Coast location. Once it reaches there, you would then do another transfer to take them out of the Goods in Transit location and into the East Coast location. This interim process affects the Transfer Clearing account.

Shipment Clearing: If you do an order entry shipment prior to invoicing, it is going to use the shipment clearing account in place of Accounts Receivable. Once you’ve invoiced the goods then the Shipment Clearing gets credited and your Accounts Receivable gets debited. Disassembly Expense: If you assemble goods through Bill of Materials you can dissemble them back to their raw material. If there are any additional expenses occurred like labor in the process of dissembling the items then this is the account that is used.

Physical Inventory Adjustment: If you have any adjustments, like increasing or decreasing an inventory in Inventory Control adjustments there is a physical inventory adjustments account. This uses the physical inventory process to create the adjustment. So when you create your inventory account and count your items, if there is a difference, what is shown in the system and what is physically counted is going to create an adjustment. This is what the Physical Inventory Adjustment account would be used for.

Credit/Debit Note Clearing: Similar to Shipment Clearing but instead you would do a credit note or debit note. This account set is not going to immediately credit Accounts Receivable until you actually invoice. Instead, it is going to this clearing account.

All of these I/C Account Sets is applicable for any Costing Method whether it be Moving Average, FIFO or Most Recent Cost.